World market prices for coal have slumped and for months languished at around US$ 45/tonne, compared to US$95/tonne in February, 2014. Over the last 2 years, coal prices have more than halved and fallen almost every month.

For weeks, crude oil prices have been around US$ 30-33/barrel, sometimes falling as low as $26/barrel. Some forecasters (Goldman Sachs) predict that oil prices could stay low and do so for longer than predicted.

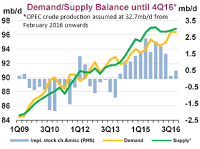

Some question if fossil fuel prices will ever recover given the emergence of disruptive technologies making electricity generation from renewable sources increasingly competitive with fossil fuels, even at their present depressed prices. Others point to agreement by OPEC to reduce production in order to stimulate price. However, that agreement has only been reached by 4 OPEC members (Saudi Arabia, Qatar, Russia and Venezuela) and then only when confronted by Iranian production coming on to the world market, following the lifting of international sanctions. It is seen by some as an ineffectual move to restore oil prices, since the agreement is not to exceed record high January pumping levels.

Far more certain is that the present price malaise is a taste of the state of things to come for those who have invested in the shares of fossil fuel producers. Without sustained price recovery, the value of shares in some fossil fuel companies will decline and could eventually wind-up as stranded assets of little or no value. Evidence of this is seen in closure of coal mines and the unsustainable position of oil and gas producers using older technology where cost of pumping oil and gas is close to or below its market value.

The Future of Oil

The present price fall for crude oil has been largely brought about by the decision of major producers to increase production to maintain income when faced with reduced demand for imported oil by China and Japan (economic slow down) and the USA (higher domestic production). The latter arises from advances in drilling and fracking technology, reducing drilling costs and vastly increasing production of gas and condensates from shale deposits and, to a lesser extent, oil.

The future for hydrocarbon producers is made more uncertain by a structural change in demand for oil products, particularly diesel and petrol. This is due to advances in battery technology, resulting in battery prices falling and increased capacity to store electricity. The result is that the range of electric cars is rapidly rising while their cost is falling. Within the next 2 years it is likely that electric cars could be selling for US$20,000 - $30,000 and have a range of 300-500 km (186-311 mi). Competition among major car builders will ensure selling price decreases and performance improves.

Goldman Sachs analysts predict that by 2025, almost 22% of all cars in use world-wide will be propelled by electricity rather than hydrocarbons. Over the next ten years the number of electric cars is expected to increase from around 1 million to over 25 million per annum. This estimate may be conservative since it is based on improved performance criteria being achieved by 2020 (Exhibit 37) which have already been surpassed.

Read more at Will Fossil Fuel Prices Fully Recover?

No comments:

Post a Comment