It’s increasingly clear that we’re not going to move off of oil because we run out of supply. Rather, we’re going to move off of oil because it is both the economic and moral thing to do.

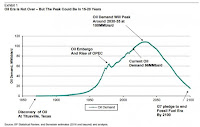

The research firm Bernstein notes that two “existential threats to the oil industry” exist — “climate change” and “advances in battery technology and computing power, which have resulted in a surge in interest in electric vehicles and autonomous driving.” They project the peak in oil demand could come as soon as 2030-2035:

This projection is quite similar to one from Bloomberg New Energy Finance (BNEF) that I wrote about earlier this year.

You know the oil industry is in long-term trouble when even the staid Financial Times editorializes, “Fossil fuel producers face a future of slow and steady decline” in a piece headlined, “The long twilight of the big oil companies.”

Significantly, the FT piece focuses exclusively on the implications of the “international objective of holding the increase in global temperatures to ‘well below’; 2C, agreed at the Paris climate talks.” This objective “implies the obsolescence of all fossil fuel production within the next few decades. The oil companies have not yet reconciled themselves to quite what this means.”

The Financial Times ends by bluntly laying out just what this means:

Instead of railing against climate policies, or paying them lip-service while quietly defying them with investment decisions, the oil companies will serve their investors and society better if they accept the limits they face, and embrace a future of long-term decline.

Existential threat #1 to oil, the ever-worsening reality of climate change, makes peak demand inevitable in the next few decades. Existential threat #2, the ever-improving reality of electric car batteries, will be one of the primary instruments of demand destruction.

Bernstein Research explains:

Bernstein Research explains:

While their share of the overall transport market is small, EVs [electric vehicles] and PHEVs [plug-in hybrid electric vehicles] will gain market share over time and eventually have a material impact on demand growth. While we do not foresee this being material in the next five years, EVs will start to have an impact toward the middle of the next decade.

Similarly, BNEF has projected “electric vehicles could displace oil demand of 2 million barrels a day as early as 2023. That would create a glut of oil equivalent to what triggered the 2014 oil crisis.”

Click to read more Big Oil Is Terminal

Click to read more Big Oil Is Terminal

No comments:

Post a Comment