- Storm comes as U.S. flood insurance program is up for renewal

- Texas has one of the most relaxed approaches to building codes

Hurricane Harvey has highlighted a climate debate that had mostly stayed out of public view -- a debate that’s separate from the battle over greenhouse gas emissions, but more consequential to the lives of many Americans. At the core of that fight is whether the U.S. should respond to the growing threat of extreme weather by changing how and, even where, homes are built.

Who Pays for the Rising Cost of Natural Disasters: QuickTake Q&A

That debate pits insurers, who favor tighter building codes and fewer homes in vulnerable locations, against home builders and developers, who want to keep homes as inexpensive as possible. As the costs of extreme weather increase, that fight has spilled over into politics: Federal budget hawks want local policies that will reduce the cost of disasters, while many state and local officials worry about the lost tax revenue that might accompany tighter restrictions on development.

Harvey slammed ashore in Texas Friday with historic levels of rain and flooding. On Wednesday, the storm returned, making landfall a second time in southwestern Louisiana, which was devastated by Hurricane Katrina in 2005. At least 15 people have died so far in Texas, according to a count by the Austin American-Statesman newspaper. Thousands more have been displaced from their homes. Early estimates on damages range from $42 billion to more than $100 billion.

Contributing to the high losses is the fact that Texas, despite being one of the states most vulnerable to storms, has one of the most relaxed approaches to building codes, inspections, and other protections. It’s one of just four states along the Gulf and Atlantic coasts with no mandatory statewide building codes, according to the Insurance Institute for Business & Home Safety, and it has no statewide program to license building officials.

...

The consequence of loose or non-existent codes is that storm damage is often worse than need be. "Disasters don’t have to be devastating," said Eleanor Kitzman, who was Texas’s state insurance commissioner from 2011 to 2013 and now runs a company in South Carolina that constructs and finances coastal homes that are above code. "We can’t prevent the event, but we can mitigate the damage."

...

How Harvey Squeezes Congress on Flood Insurance: QuickTake Q&A

Ned Muñoz, vice president of regulatory affairs for the Texas Association of Builders, said cities already do a good job choosing which parts of the building code are right for them. And he argued that people who live outside of cities don’t want the higher prices that come with land-use regulations.

...

Ron Jones, an NAHB board member and builder in Colorado who is critical of the organization’s views on codes and regulations, said that while the focus now should be on helping people hurt by Harvey, he hoped the storm would also force new thinking.

"There’s no sort of national leadership involved," said Jones. "For them it’s just, ’Hell, we’ll rebuild these houses as many times as you’ll pay us to do it.’"

The home builders demonstrated their power again this year, when President Donald Trump reversed an Obama administration initiative restricting federally funded building projects in flood plains. "This is a huge victory for NAHB and its members," the association wrote on its blog.

Yet on other issues, Trump’s administration appears to be siding with those who favor tougher local policies. In an interview just before Harvey, FEMA chief Brock Long expressed support for an Obama administration proposal to spur more local action on resilience, such as better building codes, as a condition of getting first-dollar disaster relief from Washington.

"I don’t think the taxpayer should reward risk," Long told Bloomberg in the interview, four days before Harvey slammed into Texas.

It may seem surprising that a Republican administration would side with its Democratic predecessor on anything, especially something related to climate change. But the prompt is less ideological that practical. Over the past decade, the federal government spent more than $350 billion on disaster recovery, a figure that will almost certainly increase without major changes in local building codes and land use practice.

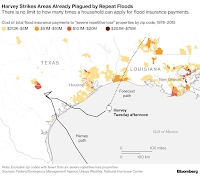

And much of that money goes to homes that keep getting hit. That’s true for the National Flood Insurance Program, which Congress must reauthorize by the end of next month; some lawmakers, and Long himself, have said homes that repeatedly flood should be excluded from coverage. But there are also 1.3 million households that have applied for federal disaster assistance money at least twice since 1998 -- many of them in the same areas hit hardest by Hurricane Harvey.

Read more at Harvey Could Reshape How and Where Americans Build Homes

No comments:

Post a Comment